The Truth About Altcoins

The Truth About Altcoins

Have you noticed that as the price of Bitcoin goes up, altcoin prices go up? And have you also noticed that as the price of Bitcoin goes down, altcoin prices go down? This might seem like basic information if you are already a crypto-enthusiast. But perhaps, like myself, you would like to have a deeper understanding of what exactly is happening with the price volatility of alt-coins and why they so closely follow the troughs and peaks of Bitcoin. I also wanted to play around with concepts from traditional economic theory, such as supply and demand, and cross-price elasticity, to help frame what is going on.

What is an Altcoin?

Briefly put, an altcoin is an alternative to Bitcoin. Bitcoin was the first cryptocurrency set up to be ‘magical internet money’. It’s use case was as a currency. An altcoin is a cryptocurrency also using a blockchain for decentralized exchange, but with a different use case or end goal in mind. Sometimes its goal is to be something other than a currency. An altcoin may also improve on Bitcoin, the original cryptocurrency, in some way, such as in speed or the kind of data that is stored in the blockchain other than transactions. (If this content is unfamiliar to you, and you are new to the crypto space, start here.)

The Pattern

Let’s start with the observable phenomenon. Taking a broad view of the crypto market from 2013, we can see that most cryptocurrencies follow a similar price movement. [1] And Bitcoin’s oscillations are slightly more stable in their volatility than those of the altcoins that accompany it. The pattern is obvious and is the market indication of an industry that is speculative due to being in its early stages. There have been multiple waves of entry into the market by new coins and new adoption as users discover crypto, each wave larger than the one before. But this growth due to ideation and discovery is not the same as projects actually differentiating themselves to the point of establishing their own economies, independent of Bitcoin. Bitcoin was the forerunner of a new kind of money, allowing a re-energising of existing industries, particularly those in the finance sector. What followed, the generation of alternatives to Bitcoin, altogether created a whole new industry itself. But the fact that altcoin prices follow Bitcoin’s price is the clearest signal that the industry is still speculative. But how exactly does that work and what does that mean?

Complementary Goods

Looking through a traditional economic lens, bitcoin and altcoins are viewed in the minds of consumers (users) as complementary goods (coins). This is what the price movements show and how the markets behave, even if that’s not what projects or users claim. Complementary goods are those that have joint demand. [2] This means that as the demand for Good A, let’s say Bitcoin, goes in a certain direction, the demand for Good B, let’s say an altcoin, goes in the same direction. The same also goes for price, which is directly related to demand. These relationships between goods are also described as cross-price elasticity, because the change in demand of one good is often compared to the change in price of another good. The opposites of complementary goods are substitute goods, where as demand for one falls, usually due to higher prices, demand for the other rises since the buyer can use it as a cheaper substitute. In our example here, the complementary relationship means that users are viewing alternative cryptocurrencies not as substitute goods but complementary goods that come along with Bitcoin. Examples of complementary goods are cars and gasoline, where the demand for gasoline is dependent on the number of cars being used that require it.

For crypto, this complementary relationship is a sign of dependence and inadequate differentiation in the market. Many of these altcoins were established to be a better version of bitcoin, faster, more private, with more functions. The price movement should show that these Bitcoin alternatives are substitutes if consumers were really using them as such; but it doesn’t. Furthermore, many of these altcoins are not trying to be used like Bitcoin, but are tokens for innovative ways of implementing existing types of businesses. However, the market shows that they are currently considered similar and serving the same need in the users’ minds. If coins are not related to a cash use like Bitcoin at all, their price activity should be different, neither perpetually similar or opposite, since they are providing an unrelated service. And if they are to be substitutes to Bitcoin, then we should see an inverse relationship in ongoing countertrends.

This is one way of understanding what is going. It is likely due to the immaturity of the crypto industry, and Bitcoin being the first-comer, with many people associating cryptocurrency with Bitcoin itself. Newcomers may enter the market and put their funds in Bitcoin only, giving Bitcoin dominant market-share, another way of looking for independence vs. dependence. The users who use Bitcoin may use other altcoins but leave most of the money that they bring into the space in Bitcoin. Looking at market behavior, Bitcoin is akin to the personal computer, the real innovation, and all the other altcoins are like CDs and DVDs, ideas to play around with. I didn’t say it. The market did.

Arbitrage

There is another important factor to consider when it comes to price activity, however, that could be obscuring signals of actual consumer behavior. Something else is occurring on exchanges as Bitcoin falls and rises. You would think that when someone in Paris sells Bitcoin to someone else in Europe, assuming they are on a regional exchange, that the price of another unrelated altcoin couldn’t fall because no one has the speed to actually sell something at exactly that time. How could the sale of an altcoin match up perfectly with the sale of Bitcoin? The answer is trading bots. There are trading bots that are constantly arbitraging against Bitcoin. What this means is that there are a significant number of exchange transactions that aren’t real buys and sells from real people using these tokens for real things, depending on your perspective. That’s why altcoins can follow the price so closely. Take a look at your favorite altcoin in a chart that’s matched up with a Bitcoin chart in its observable time period and units of time. For example, as the price of BTC goes up sharply, a bot will often sell an altcoin in order to get BTC as it is going up. Then, once BTC flatlines it immediately buys back the altcoin it sold. This is in an effort to get more of either coin, trying to suck the equity out of the gap. It also happens when BTC goes down, where an altcoin will be dumped to buy BTC. In general, the volume of the movement may differ but the timing is always the same, even in small units of time. (I am not a trader and this is not trading advice.) Many altcoins are at the whim of what trading bots do, if not at the whim of human traders as well who trade against BTC. Regardless, if authentic consumer behavior can be obscured by this kind of trading, that in itself is an indicator of a lack of true adoption and creation of an independent economy.

“The Network Effect”

One final thing to consider is the higher volatility that altcoins can have compared to BTC, which is volatile itself. On top of arbitrage bots linking pairs together, most altcoins tend to be valued against BTC and are only able to be bought with BTC. There are much more BTC pairings than altcoin pairings. So altcoins tend to be more volatile, due to what I call a network effect, that depends on the number of exchanges available for an altcoin and the number of pairings it has available. The more pairings you have to go through to exchange an altcoin for fiat, the more transaction fees have to be paid. Going from BTC to USD is longer and costlier than going from ETH to BTC to USD. This is one hindrance of buying and selling an altcoin, compared to BTC. Altcoins also have fewer exchanges available for buying or selling. This makes their swings more extreme. When you decide to sell an altcoin, lowering the price, there are less buyers available to bring the price back. Buyers compete in numbers and speed to affect how low the price is able to get. But someone who decides to sell BTC has more choices available, due to the number of exchanges. The amount of ‘points’ on the network available to respond to your transaction request, due to exchanges, affects how long transactions take and quickly prices can be bid back up, or vice versa. Minor fluctuations for BTC become depressing consequences for altcoins. To put it into perspective, Bitcoin’s availability of buyers and exchanges is still limited compared to those of fiat currencies, which less volatile, with much more volume and choices available to immediately counter bid, up or down, when someone posts a transaction.

Altcoins with Independent Economies

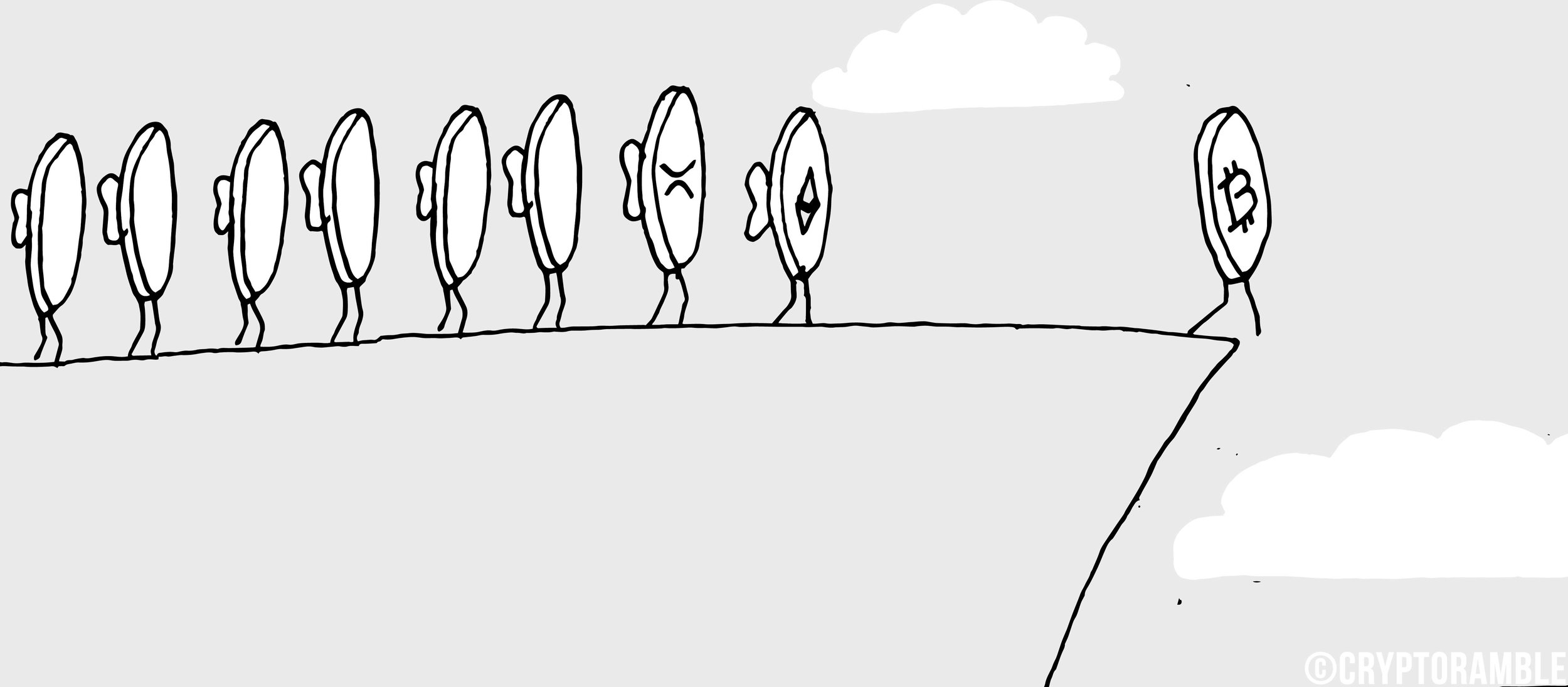

So what’s the takeaway after understanding why altcoins have such a devotion to Bitcoin? Whenever we see a sustained counter trend of an altcoin, that is when we will know that a coin has differentiated itself enough to establish its own independent economy. This is different from a temporary pump and dump. It can only happen when adoption begins to occur, allowing the volume of buying and selling between humans to outrun the arbitrage, potentially showing an inverse relationship as a substitute to Bitcoin, or unrelated price movements if it has nothing to do with what Bitcoin offers. This is when you will know, apart from what I or the media or your favorite crypto news source says, that true differentiation and adoption is occurring, and crypto is finally exiting the era of speculative trades.

There are many projects that have the potential to form their own independent economies. But projects are at different stages of speculation versus substantive development that will bring adoption. How many crypto projects are being used or traded for the application itself? There are almost none. Bitcoin itself is the closest. Ethereum was one of the first coins to break away from Bitcoin’s movement. It was, at one point, bringing in outside money from its ERC20 tokens, enabling it to have some of its own economy for some time. It could truly breakaway from crypto speculation in time as projects develop. But its price independence did not sustain itself and continuously reduces as projects cash out their Ethereum to pay for development in the bear market. EOS, due to its similarity to Ethereum, is also likely to establish an independent economy. One coin I am bullish on is Particl, as with the right volume of sales per day on its marketplace, public or private, trading bots can no longer drag the price wherever Bitcoin goes. It’s my hope that Particl is among the first real wave of adoption outside of speculation projects. Nothing says independent economy quite like a marketplace, and it is already in its testing phase. There are substitutes to Bitcoin such as Bitcoin Cash that for a moment also displayed counter trends. There are coins that you will have more insight on than I do. Eventually, there will be other anchor or reserve currencies because they will have their own use cases, regardless of whatever is happening with other projects. For now, altcoins are tethered to Bitcoin because cryptocurrency technology is in a phase of early development, and they lack independent economies of their own. It’s no wonder that if Bitcoin fell off a cliff, all of crypto would too.